Most Requested

Most Requested

The tabs below contain the 20 most requested forms and other documents for each category. If the document you want is not here, search by keyword or browse by your membership status (New Employee, Active Member, Retiree, Beneficiary).

Authorization for Direct Deposit (EFT) of Monthly Retirement Allowance

Form #380

Direct Deposit is easy, convenient, and secure. No more waiting for the check to arrive; no more trips to the bank in bad weather!

Application for Service Retirement – Tier 2, Tier 3, Tier 4, and Tier 6

Form #521

Application for members who wish to apply for Service Retirement.

Designation of Beneficiary – Post-Retirement Lump-Sum Death Benefit – Tier 2, Tier 4, and Tier 6

Designation of Beneficiary applications are no longer available for download on nycers.org.

To make changes to your beneficiaries or their designated guardians, log in to your MyNYCERS account and look for “Manage Beneficiaries” in the menu.

Don’t have a MyNYCERS account? Register for immediate access.

Need help? For assistance accessing your MyNYCERS account, contact NYCERS at 347-643-3000.

To request a paper application, contact NYCERS’ Call Center or visit us at the Walk-in Center.

Application for Membership for NYCERS-Eligible Employees – Tier 3, Tier 4, and Tier 6

Form #103

For City employees who wish to apply for NYCERS membership. You may also nominate a beneficiary for a death benefit payable if you die while in City service.

Change of Address

Form #290

Submit this form if you wish to change the address that NYCERS has on file for you.

Loan Application – Tier 3, Tier 4, and Tier 6 Basic and Special Plan

Form #302

Application for eligible Tier 3, Tier 4 and Tier 6 Basic and Special Plan members who wish to apply for a NYCERS pension loan.

Application to Purchase Credit for Service Rendered Prior to Membership Date in NYCERS (Buyback)

Form #241

Use this application to purchase (buyback) previous full-time or part-time public service rendered within New York State prior to your NYCERS membership. Note: Tier 1 members may only buy back public service rendered in a NYCERS-eligible title.

Affidavit Concerning Lost Check

Form #399

For faster service, report a lost check by logging in to your MyNYCERS account.

Note: You must wait 10 business days after the check mailing date before reporting the check as lost.

Retirement Option Election Form – Tier 4, Tier 6 63/5, and Special Plan Members – Maximum, Option 1, 2, and 5

Form #556

This Retirement Option Election Form allows you to elect either the Maximum Retirement Allowance or an option that provides a continuing benefit to your designated beneficiary after your death. By electing a retirement option, you will receive a reduced retirement benefit.

Application for Refund of Member’s Accumulated Salary Deductions

Form #331

For members who wish to receive a refund of their accumulated salary deductions. Note that by withdrawing your accumulated salary deductions, your membership and all associated rights, benefits, and privileges will end.

Affidavit of Personal Service Income

Form #351

This form is to be completed annually by all Tier 3, Tier 4 and Tier 6 Disability Retirees to verify your eligibility for continued disability benefits. Find out more about Personal Service Income.

Application for Transfer of Member’s Accumulated Salary Deductions to Another Retirement System Within New York State

Form #321

If you accept another position with the City or State of New York (or any of its political subdivisions) that entitles you to membership in another City or State retirement system, you may use this form to transfer your NYCERS membership to that system.

Application for Change in Loan Repayment Schedule – Tier 3, Tier 4 and Tier 6

Form #309

For Tier 3, Tier 4 and Tier 6 Basic and Special Plan members who wish to change their loan repayment schedule.

Name Change Application

Form #291

For members, retirees, and beneficiaries who have changed their first or last name. You must attach proof of a legal name change, such as a copy of a Marriage Certificate or Judgment of Divorce.

Notice of Intention to File for a Tier 3, Tier 4, Tier 6 or 22-Year Plan Vested Retirement Benefit

Form #254

For Tier 3, Tier 4, Tier 6 and 22-Year Plan members who wish to vest their retirement benefit. Vesting refers to your right to receive plan benefits even if you terminate employment before you are eligible for payment of a Service Retirement Benefit.

Agency-to-Agency Transfer Notification

Form #233

This form is to be completed by any agency to notify NYCERS when a new employee who is ALREADY a NYCERS member has transferred from (1) any NYC agency; (2) NYC Transit or MTA Bridges and Tunnels; (3) any facility of the NYC Health and Hospitals Corporation; or (4) any campus of the City University of New York.

Birth Evidence Affidavit

Form #205

Submit this affidavit if you are unable to produce a birth certificate or any of the birthdate evidence documents accepted by NYCERS but can submit three alternative birth records. For a list of acceptable birthdate evidence, see NYCERS’ Birthdate Evidence Alternatives Fact Sheet #709.

Calculating Your Retirement Benefit – Tier 4 62/5, 57/5 or 55/25

Brochure #927

How the Service Retirement Benefit is calculated for Tier 4 members.

Retirement Options – Tier 4 and Tier 6 Basic and Special Plan

Brochure #926

This brochure describes the retirement options for Tier 4 and Tier 6 Basic and Special Plan members. By selecting an option, you accept a reduced lifetime retirement allowance in exchange for the payment of a benefit to your designated beneficiary upon your death. If you do not select an option, you will be awarded the Maximum Retirement Allowance. Be sure you understand each option before you submit your retirement forms.

Calculating Your Final Average Salary (FAS) – Tier 4

Brochure #929

How NYCERS determines a Tier 4 member’s Final Average Salary (FAS).

57/5 Retirement Plan for Tier 4 Members

Brochure #945

Participants in the 57/5 Retirement Plan who have five or more years of Credited Service, at least two years of which are Membership Service, are eligible to receive a Service Retirement Benefit at age 57.

62/5 Retirement Plan for Tier 4 Members

Brochure #946

The 62/5 Retirement Plan, also referred to as the Basic Tier 4 Plan, allows participants to retire with a full pension at age 62 with at least five years of Credited Service, or with a reduced pension between the ages of 55 and 61.

Earnings Limitations for Service Retirees and Disability Retirees

Brochure #958

This brochure describes the earnings limitations that service and disability retirees may be subject to if they decide to return to public service within New York City or New York State.

63/5 Retirement Plan for Tier 6 Members (Tier 6 Basic Plan)

Brochure #993

The 63/5 Retirement Plan for Tier 6 members (Tier 6 Basic Plan), allows participants to retire with an unreduced pension at age 63 with at least five years of Credited Service, or with a reduced pension earlier than age 63 but no earlier than age 55.

Loans – Tier 3, Tier 4, and Tier 6 Basic and Special Plan Members

Brochure #911

Information about loan eligibility, borrowing capacity, and filing and processing a loan application for members in Tier 3, Tier 4, and Tier 6 Basic and Special Plans.

Buy-Back – Purchasing Credit for Service Rendered Prior to NYCERS Membership

Brochure #901

The benefits and the process for purchasing previous public service (buy-back).

55/25 Retirement Plan for Tier 4 Members

Brochure #944

Participants in the 55/25 Retirement Plan who have 25 or more years of Credited Service, at least two of which are Membership Service, are eligible to receive a Service Retirement Benefit at age 55.

Leaving City Service – Tiers 3, 4, 6 and 22-Year Plans

Brochure #908

Learn about the rights and options available to you after leaving City service. Many options are time-sensitive; we encourage you to read this brochure prior to leaving City service.

Attention Non-Members: You may want to join NYCERS before leaving City service. By becoming a NYCERS member, you preserve your right to membership in the current tier. This may be beneficial if you return to public service in New York City or New York State in the future.

Transit Operating Force 25-Year/Age 55 Retirement Plan for Tier 6 Members

Brochure #986

This brochure outlines the obligations and benefits of the Transit 25-Year/Age 55 Retirement Plan forTier 6 members (6TR-25). The 6TR-25 Plan allows participants to retire with 25 years of Allowable Service at age 55 and is available only to those employed in a Transit Operating Force (TOF) position.

Sanitation 20-Year Retirement Plan for Tier 4 Members (SA-20)

Brochure #935

This brochure describes the benefits of the Sanitation 20-Year Retirement Plan (SA-20) which is available ONLY to employees in the uniformed-force of the NYC Department of Sanitation.

Uniformed Sanitation Force Tier 3 22-Year Retirement Plan (SA-22)

Brochure #995

This brochure describes the obligations and benefits of the Uniformed Sanitation Force 22-Year Plan (SA-22). This plan allows participants to retire for service after rendering at least 22 years of Credited Service, regardless of age.

Calculating Your Retirement Benefit – Tier 4 Transit 25-Year/Age 55 Plan

Brochure #930

How the Service Retirement Benefit is calculated for Tier 4 members in the Transit 25-Year/Age 55 Plan.

Military Buy-Back

Brochure #902

Eligibility, benefits and application process to purchase service credit for time spent on active duty in the U.S. military.

Uniformed Correction Force Tier 3 22-Year Retirement Plan (CF-22)

Brochure #994

This brochure describes the obligations and benefits of the Uniformed Correction Force 22-Year Plan (CF-22). This plan allows participants to retire for service after rendering at least 22 years of Credited Service, regardless of age.

Correction Officer 20-Year Retirement Plan

Brochure #918

This brochure describes the benefits of the Correction Officer 20-Year Retirement Plan (CO-20 Plan). The CO-20 Plan is available ONLY to NYCERS members employed by the NYC Department of Correction in a Correction Officer Title below the rank of Captain (COT) for the first time prior to October 19, 2004.

Transit Operating Force 25-Year/Age 55 Retirement Plan for Tier 4 Members

Brochure #910

This brochure outlines the benefits of the Transit 25- Year/Age 55 Retirement Plan (T25/55 Plan). The T25/55 Plan is available only to those employed in a Transit Operating Force (TOF) position.

Vesting – Tier 3 and Tier 4

Brochure #904

Vesting is your right to receive a retirement benefit in the future if you have met the requirements of your plan even if you leave City service before you are eligible to retire.

Pension Payment Calendar

Download your Pension Payment Calendar here and never wonder when your next payment will be issued.

Tier 4 Age and Service Requirements for Retirement Eligibility

This Fact Sheet provides Age and Service requirements for various Tier 4 retirement plans at a glance.

Tier 6 Age and Service Requirements for Retirement Eligibility

This Fact Sheet provides Age and Service requirements for various Tier 6 retirement plans at a glance.

Processing Death Benefits

Fact Sheet #702

An overview of NYCERS’ policies and procedures for processing a death benefit claim.

Tier 6 Basic Plan

Fact Sheet #718

An overview of the 63/5 Retirement Plan for Tier 6 members.

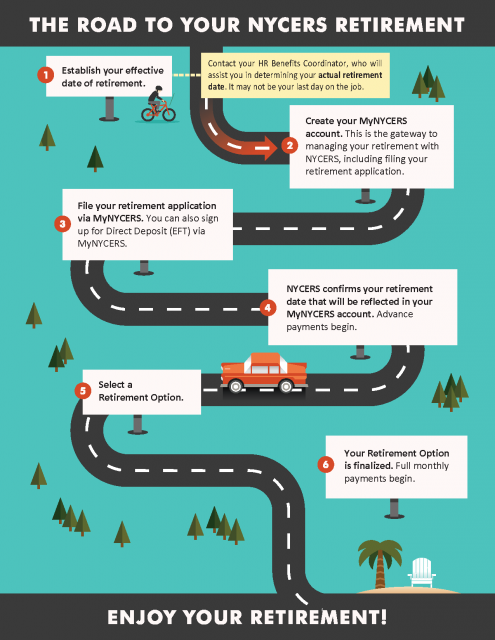

The Road to Your NYCERS Retirement

Fact Sheet #716

Retiring from your City job is an important step and the beginning of an exciting time in your life! On a practical note, it’s a process that will take at least a few months to complete and can go more smoothly if you fully understand what to do and what to expect. Here at a glance are your 6 Stops on the Road to Retirement.

Cost-of-Living Adjustment (COLA)

Learn about COLA eligibility criteria for NYCERS retirees and beneficiaries, payment timing, and how the COLA rate is calculated.

How to Join NYCERS

Fact Sheet #754

This Fact Sheet will show you how to join NYCERS online using your smartphone, laptop or tablet.

5@55 Legal Checklist

Fact Sheet #726

A key part of retirement planning is to make sure you are prepared for the health and legal needs you may face. Here is a handy checklist to help you complete five key documents you need by age 55, but no later than retirement.

Participating Employers

Fact Sheet #724

A list of Participating Employers whose employees are eligible for membership in NYCERS.

Simultaneous Filing of Retirement Applications

Fact Sheet #756

This fact sheet answers commonly asked questions regarding simultaneous filing.

Birthdate Evidence Alternatives

Fact Sheet #709

A list of alternative documentation that NYCERS will accept as evidence of birthdate if you cannot provide a legible, English-language birth certificate. Depending on the document(s) you provide, you may also be required to submit NYCERS’ Birth Evidence Affidavit #205.

Tier 3 Age and Service Requirements for Retirement Eligibility

This Fact Sheet provides Age and Service requirements for various Tier 3 retirement plans at a glance.

Physically Taxing Titles

Fact Sheet #712

Information for Chapter 96 members employed in a physically taxing title. Use this fact sheet together with the brochure describing your Chapter 96 Plan for a complete understanding of your benefits and obligations. This fact sheet includes the Official List of Physically Taxing Positions.

All Tiers – Maximum Compensation Limit under IRC 401(a)(17)

Fact Sheet #727

This fact sheet provides the Maximum Compensation Limit under Internal Revenue Code (IRC) 401(a)(17) for 2024 and prior retirements, as applicable.

Personal Service Income

Fact Sheet #725

Tier 3, Tier 4 and Tier 6 disability retirees are required each year to report any earnings from the public or private sector (Personal Service Income). This fact sheet provides answers to the most frequently asked questions regarding Personal Service Income.

How to Qualify for the COVID-19 Accidental Death Benefit

Fact Sheet #748

This fact sheet describes the eligibility, filing, and documentation requirements which must be met in order to qualify for the COVID-19 Related Accidental Death Benefit.

Loan Reduction Factors for 2024 Retirements

Fact Sheet #714

The benefit reduction in dollars for every $1,000 of an outstanding loan for 2024 retirements.

Tier 1 Age and Service Requirements for Retirement Eligibility

This Fact Sheet provides Age and Service requirements for various Tier 1 retirement plans at a glance.

Loan Taxability Fact Sheet

Fact Sheet #706

An explanation of the taxability of your loan.